Contribution margin rate

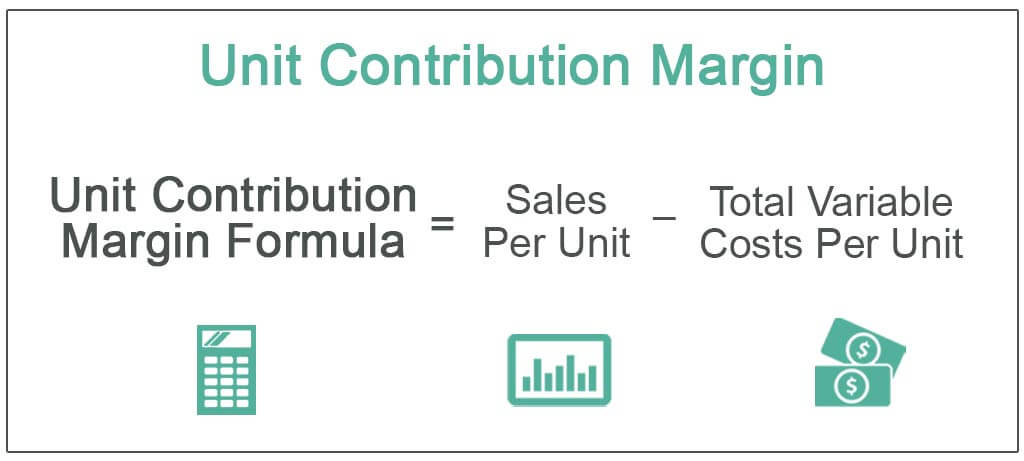

The contribution margin formula is quite straightforward. As unit contribution margin formula Sales per unit Total Variable costs per unit.

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

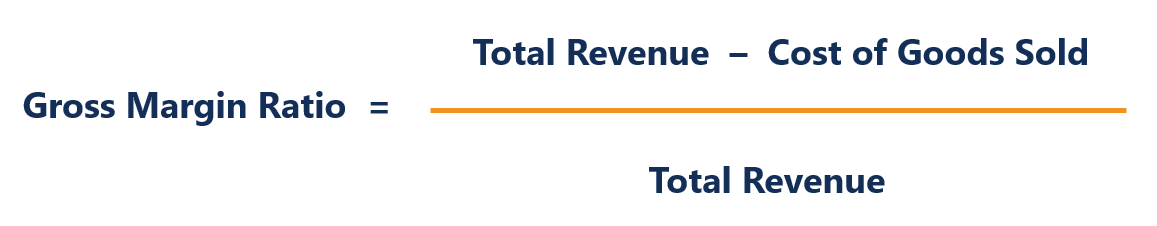

How Does Gross Margin And Net Margin Differ

You subtract the 300000 in fixed costs to get 200000 in operating profit.

. The key to using the formula above is to find only the revenue that comes. Contribution margin ratio Rs. 2500 1000 1500.

150 803010 150-120 30. Contribution Margin Ratio Contribution MarginSales 120000200000 060 or. The contribution margin ratio is the difference between a companys sales and variable expenses expressed as a percentage.

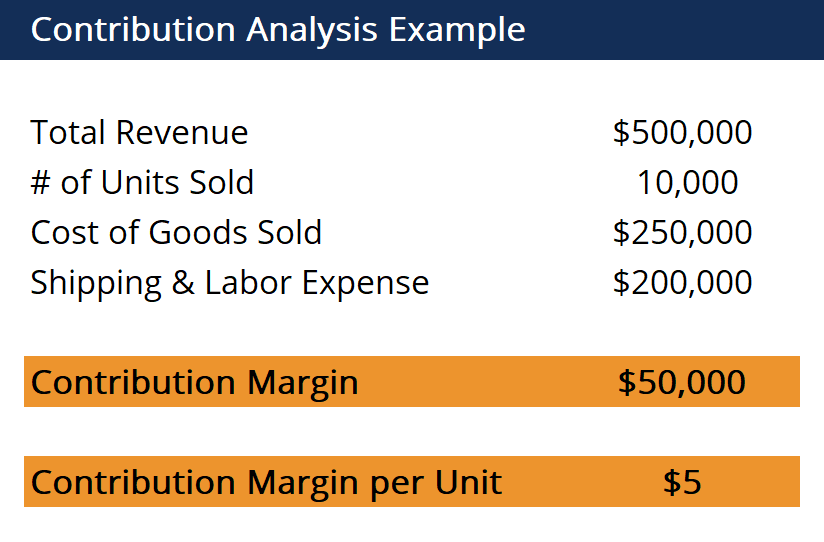

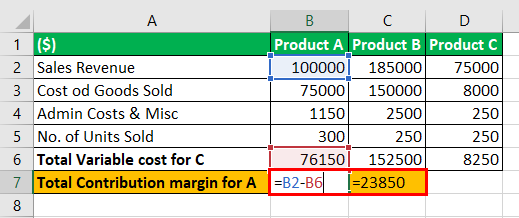

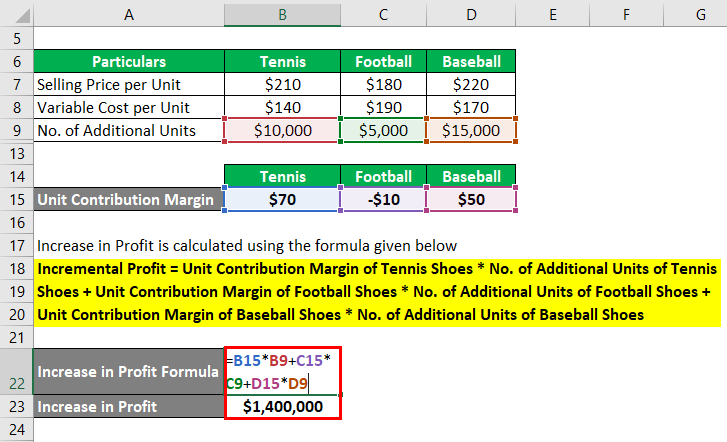

All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units. Contribution Margin INR 200000 INR 140000. Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products.

Contribution Margin Net Sales Total Variable Expenses. Case cancellation rate 10 510 5 Post Anesthesia. The contribution margin ratio shows a margin of 83 50006000.

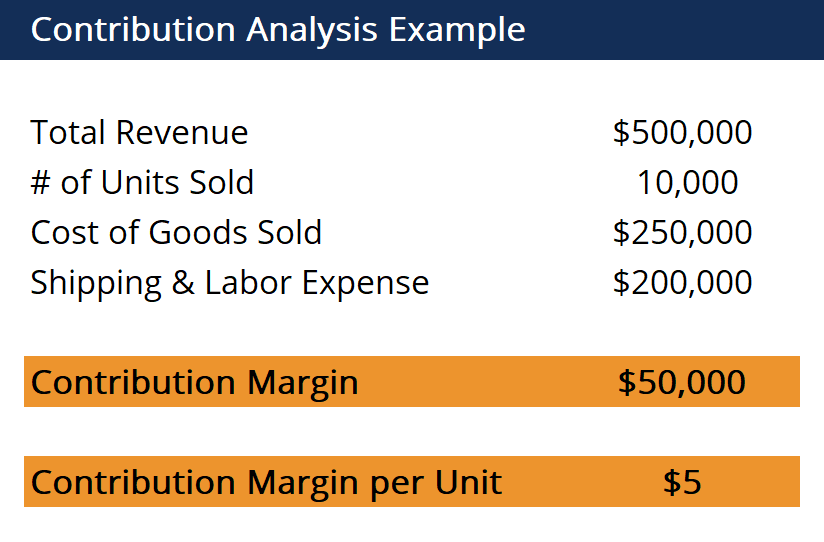

The analysis can be split up into contribution margin CM also known as a unit contribution which is the absolute dollar amount and contribution margin rate CMR which is the. The contribution margin is 40 which means. The first step in doing the calculation is to take a.

Next the CM ratio can be calculated using the following formula. Using the contribution margin ratio formula which is revenue variable costs divided by revenue we will compute it as follows. Product Revenue Product Variable Costs Units Sold Contribution Margin Per Unit.

It measures how growth in sales translates to growth in profits. Contribution margin percentage 60000150000 100 40. Since your total contribution margin is 500000 which is.

The phrase contribution margin can also. For example if the price of your product is 20 and the unit variable cost is 4 then the unit contribution margin is 16. Contribution margin analysis is a measure of operating leverage.

Accordingly the contribution margin ratio for Dobson Books Company is as follows. Gross margin encompasses an entire companys profitability while contribution margin is more useful on a per-item profit metric. Contribution Margin INR 60000.

Contribution margin can be used to examine. We can say that ABC Firm has left over INR. 1500 2500 60.

Contribution margin ratio 60000150000 04. The total margin generated by an entity. Your contribution margin is 500000.

The formula used to calculate the CM would be as follows. This café owner has a higher contribution margin from selling coffees but the muffin sales are much more profitable.

Contribution Margin Formula With Calculator

Unit Contribution Margin Meaning Formula How To Calculate

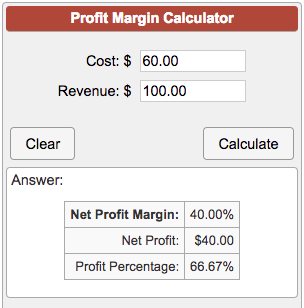

Profit Margin Formula And Ratio Calculator

Gross Margin Ratio Formula Analysis Example

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Contribution Margin Formula And Ratio Calculator

Gross Margin Ratio Learn How To Calculate Gross Margin Ratio

Gross Profit Margin Formula Definition Investinganswers

Profit Margin Calculator

Net Profit Margin Formula And Ratio Calculator

Contribution Margin Ratio Formula Per Unit Example Calculation

Contribution Margin Formula And Ratio Calculator

Unit Contribution Margin Meaning Formula How To Calculate

Contribution Margin Ratio Revenue After Variable Costs

Achieving A Desired Profit And Break Even Point In Dollars Accountingcoach

Contribution Analysis Formula Example How To Calculate

Unit Contribution Margin How To Calculate Unit Contribution Margin