37+ is form 4506-c required for mortgage

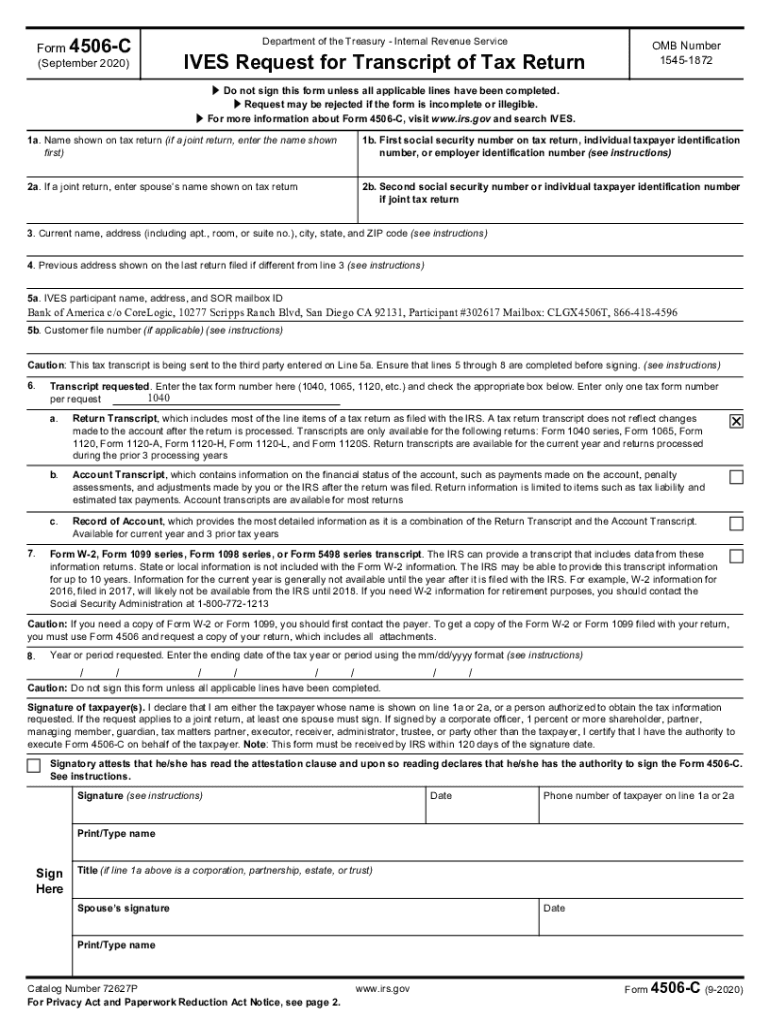

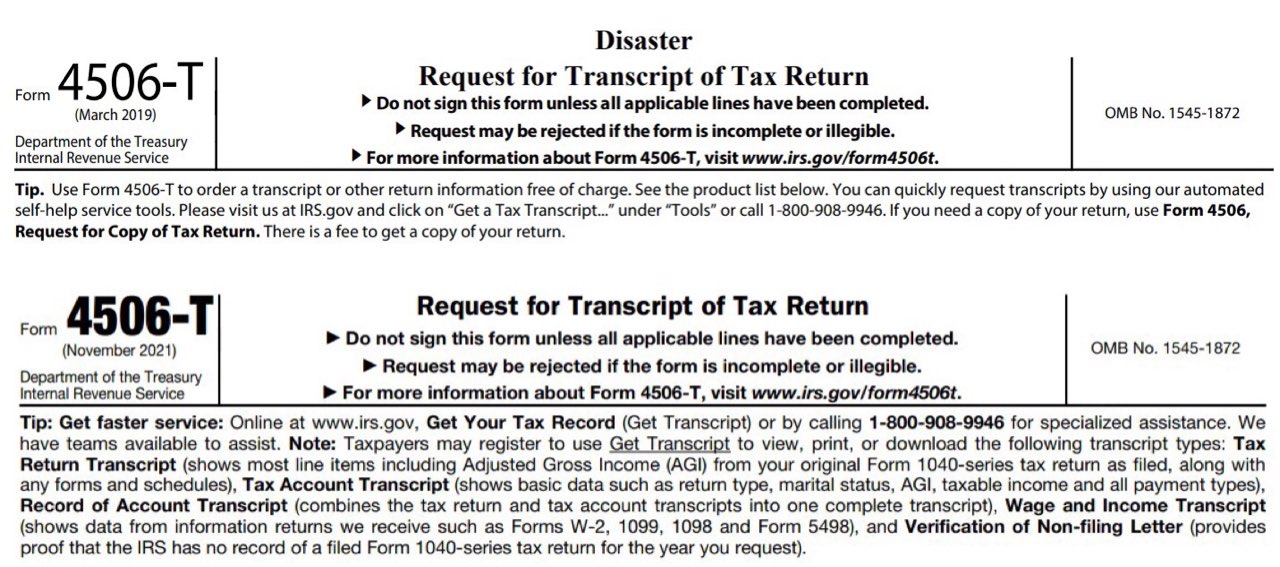

Web In short Form 4506-C is also known as Request for Transcript of Tax Return. If the borrower is self-employed a separate form 4506-C is needed for each.

Proving Taxes Are Real Filed Irs Form 4506 C Jvm Lending

The UKs 1 online mortgage broker.

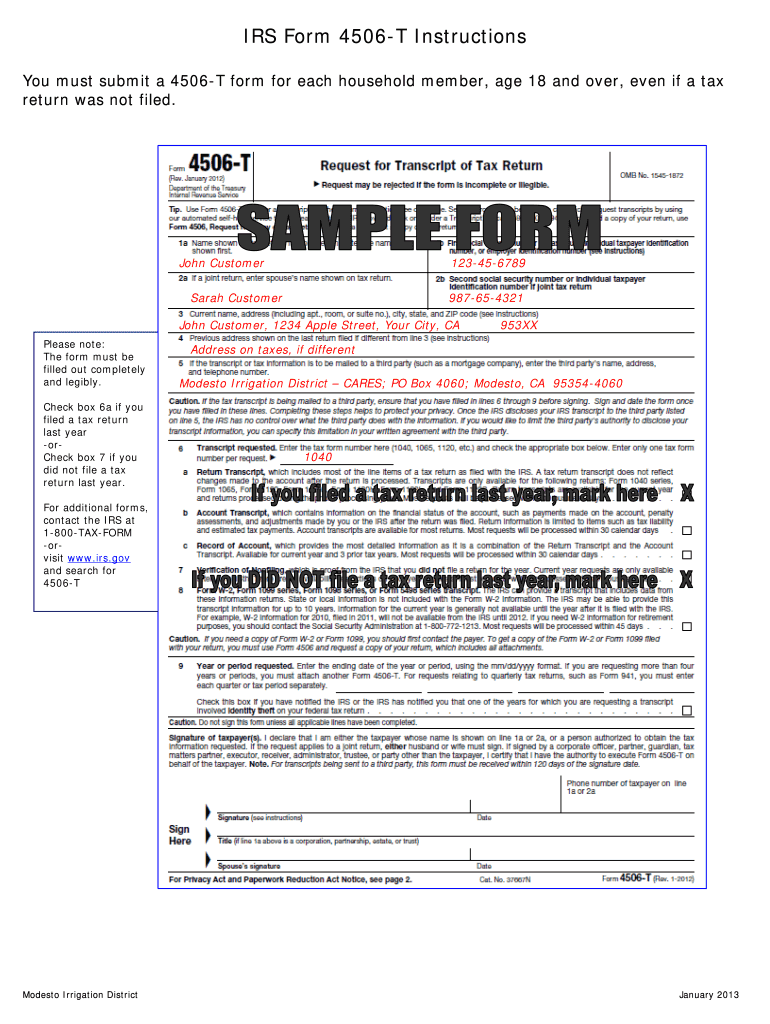

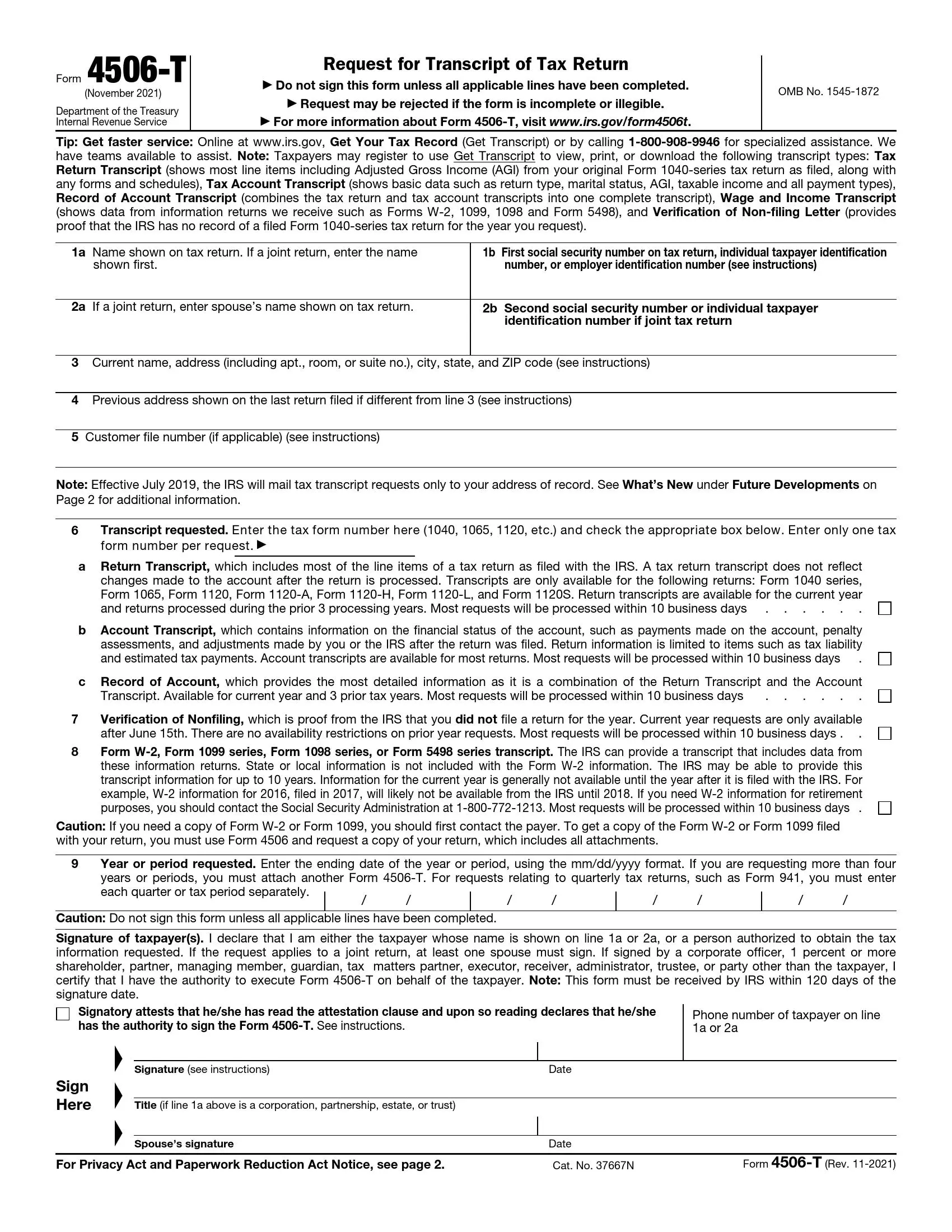

. Web A 4506-C form must be signed and completed for each borrower up to four years. Web Form 4506-C was created to be utilized by authorized IVES participants to order tax transcripts with the consent of the taxpayer. The IRS just announced a 60-day extension for their new IRS Form 4506-C which will replace the current IRS form 4506-T.

Internal Revenue Code Section 6103c limits disclosure. We are therefore planning to incorporate Form 4506. Introduced as a fraud prevention measure Form 4506 is required from nearly.

Web We do understand that there are other investors who will begin requiring Form 4506-C sooner than March 1 2021. Web On Oct. Do not sign this form unless all applicable lines have been completed.

The 4506-C is the formal authorization that. Can I fax batches that include Form 4506-C to any of the IVES fax numbers in the. Web This is why every borrower has to sign an IRS Form 4506-C formerly called a 4506-T as part of their loan disclosures.

The originator is responsible for completing and. Bettercouk Customers Saved An Average Of 369 Per Month In February 2023. Web The IRS IVES Request for Transcript of Tax Return IRS Form 4506-C gives the lender permission from the borrower to obtain tax transcripts from the IRS.

Apply Online And We Take Care of the Rest. Unlike other brokers our service is completely free. No the phone number is not required for the Form 4506-C to be processed.

Apply Online And We Take Care of the Rest. Web A form 4506-T simply allows your lender to verify with the IRS that the forms you supply to prove your income match those in the possession of the IRS. Ad Expert Mortgage Advice With No Broker Fees.

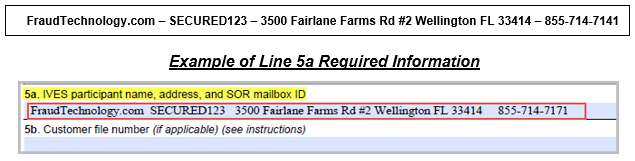

Web The information on the 4506-C Version September 2020 must match the borrowers most recently filed tax returns EXACTLY. Ensure that all applicable lines including lines 5a through 8. The UKs 1 online mortgage broker.

Ad Bespoke mortgage recommendations from the UKs largest fee free mortgage broker. 1 the Internal Revenue Service implemented an automated process for accepting 4506-C transcript request forms. Web Effective March 1 2021 only the new IRS Form 4506-C will be accepted through the Income Verification Express Service IVES to provide tax transcripts to third.

Bettercouk Customers Saved An Average Of 369 Per Month In February 2023. The expected result is a. Web A signed Form 4506-C is required to be obtained for each borrower at or before closing for all income types used in the underwriting process personal or business QC When a.

Web Updated IRS Form 4506-C Required March 1st February 8 2023 This past fall 2022 the IRS published a new version of Form 4506-C Request for Transcript of. Web If youre a mortgage lender youre undoubtedly familiar with IRS Form 4506. Web IRS Form 4506-C has been created for authorized IVES participants to order tax transcripts with the consent of the taxpayer.

Web February 23 2021. As a result of these changes we have. IRS Form 4506-C is available online.

Ad Bespoke mortgage recommendations from the UKs largest fee free mortgage broker. Web Form 4506-C must be signed and dated by the taxpayer listed on line 1a and if listed 2a. The IRS must receive Form 4506-C within 120 days of the date signed by the taxpayer or it will be rejected.

Web Form 4506-C is a valuable tool for lenders in the mortgage industry allowing them to obtain a tax transcript and verify a borrowers income and tax information. Ad Expert Mortgage Advice With No Broker Fees. Unlike other brokers our service is completely free.

Originally scheduled to start March 1 2021 the IRS will also continue to accept the current 4506-T dated September 2019 March 2019 through April 30 2021. Web If the signed IRS Form 4506-C was the correct form version at the time it was signed by the borrower and subsequently the Sellers QC is unable to use the form to obtain tax. The form may also be used.

It must be filled by the taxpayer and sent to the IRS. Web Because there is no leeway in their Handbook to hold that Form 4506-C is acceptable as well as their lack of adequate response to our inquiries we are taking a.

Irs Form 4506 Sounds Harmless Enough

Form 4506 T Rev January 2012 Monadnock Community Hospital

Form 4506 T Fill Online Printable Fillable Blank Pdffiller

Irs Form 4506 T Fill Out Printable Pdf Forms Online

How To Fill Out And Send Form 4506 T To Irs Dingtone Fax

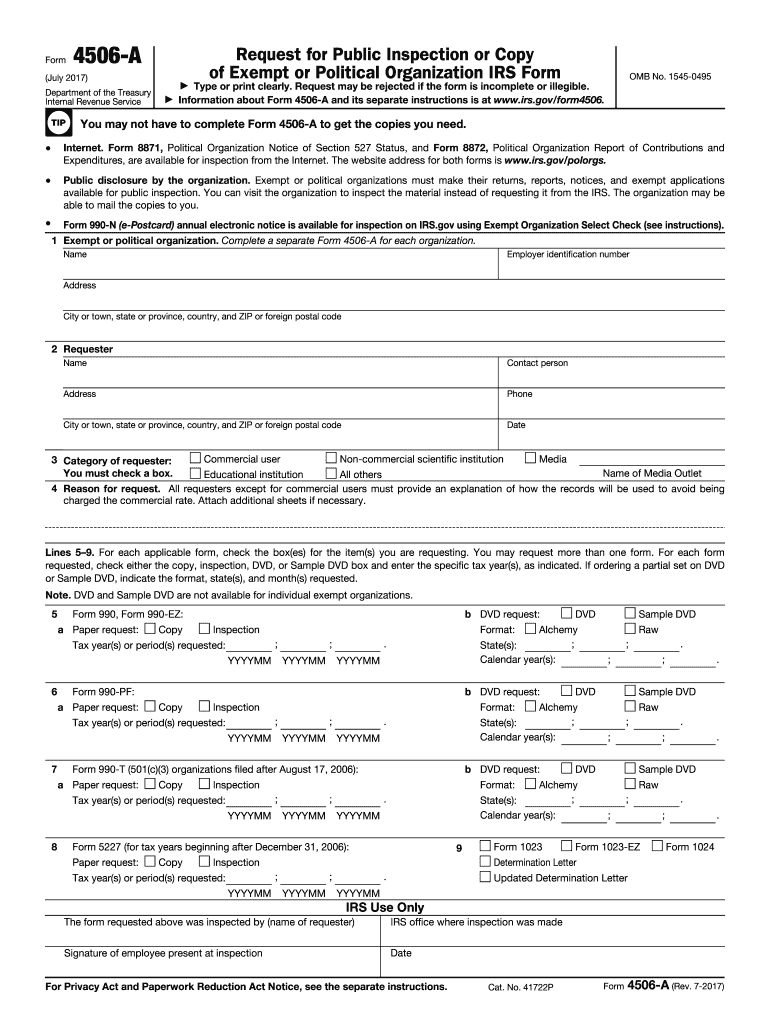

Form 4506 A 2017 Fill Out Sign Online Dochub

What Lenders Need To Know New Irs 4506 C Form Process Metasource

Back Button

Form 4506 T Instructions For Sba Eidl Loan Covid 19 Eidl Grant Or Sba Eidl Reconsideration Freedomtax Accounting Payroll Tax Services

4506 C Fillable Form Fill Out Sign Online Dochub

Elao Request For Transcript Of Tax Return Irs 4506 T

How To Fill Out And Send Form 4506 T To Irs Dingtone Fax

New 4506 C Forms Processing Requirements

Tax Question General Tax Question Please Help R Irs

New 4506 C Forms Processing Requirements

4506 T Irs Has Issued A New Form 4506t Without The Sba Logo The Sba Logo Has No Effect On Cost Or Processing Time All Lenders Should Use The Most Current Ppt

Form 4506 T With The Wrong Address This Is Their Reply R Eidl